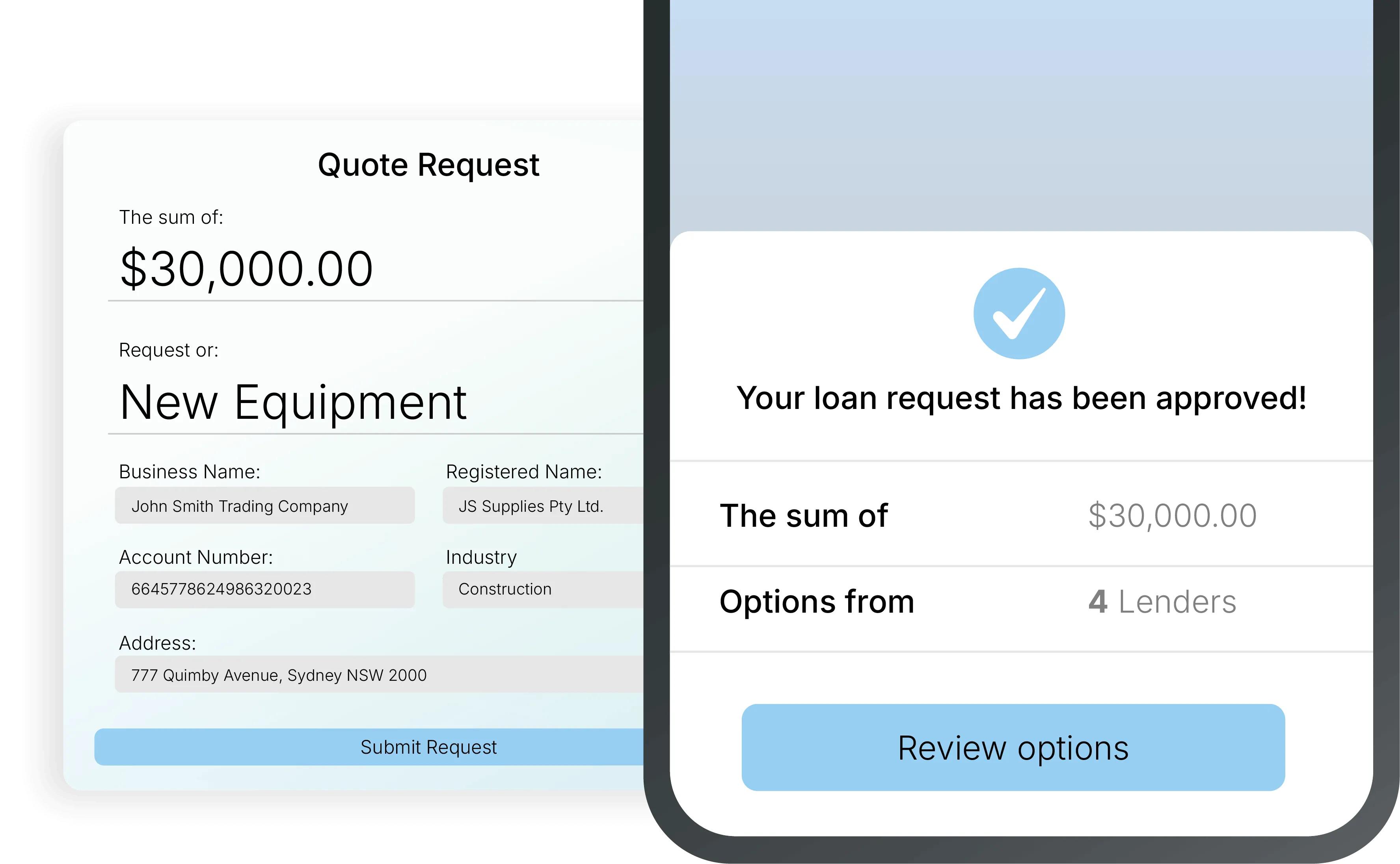

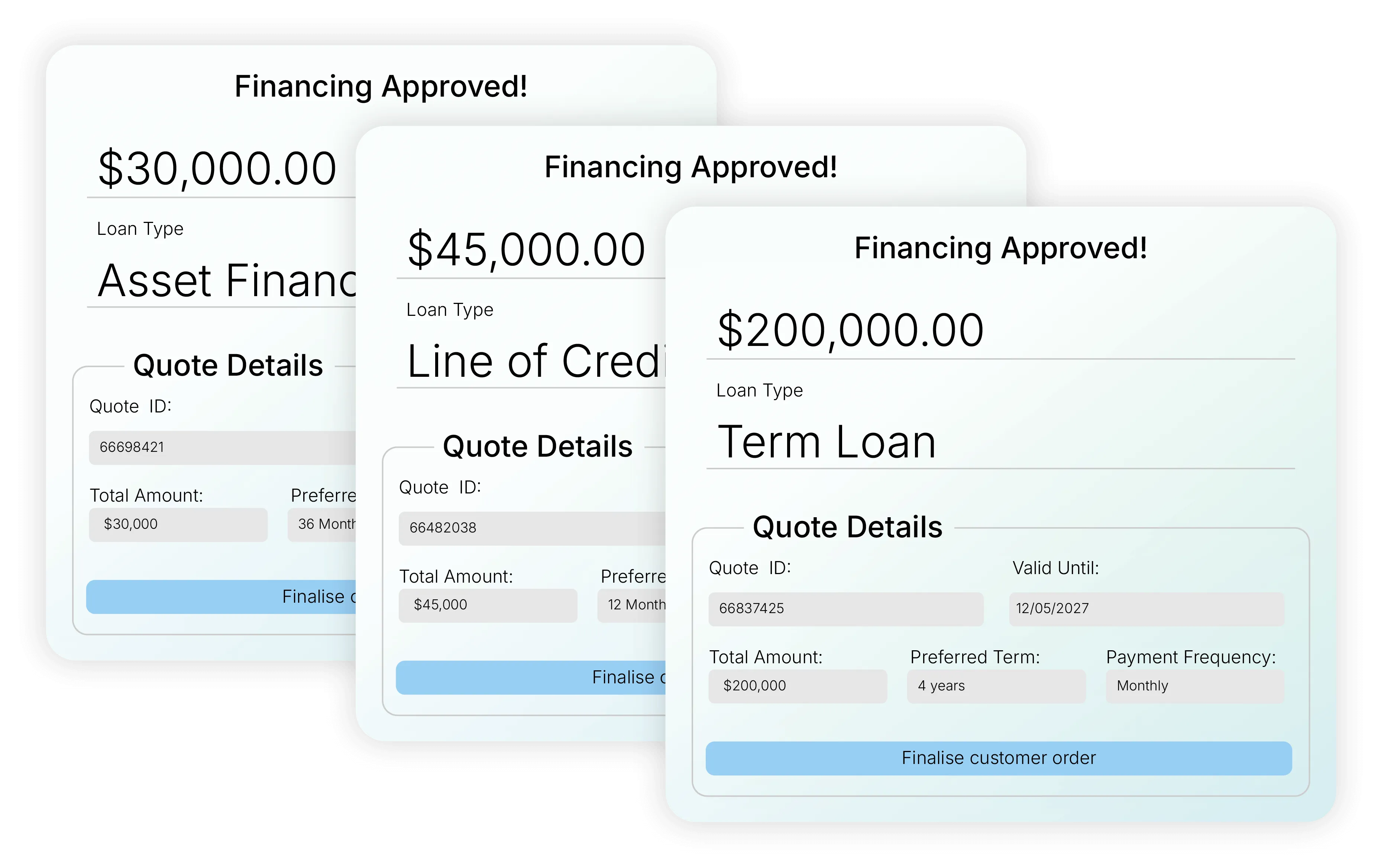

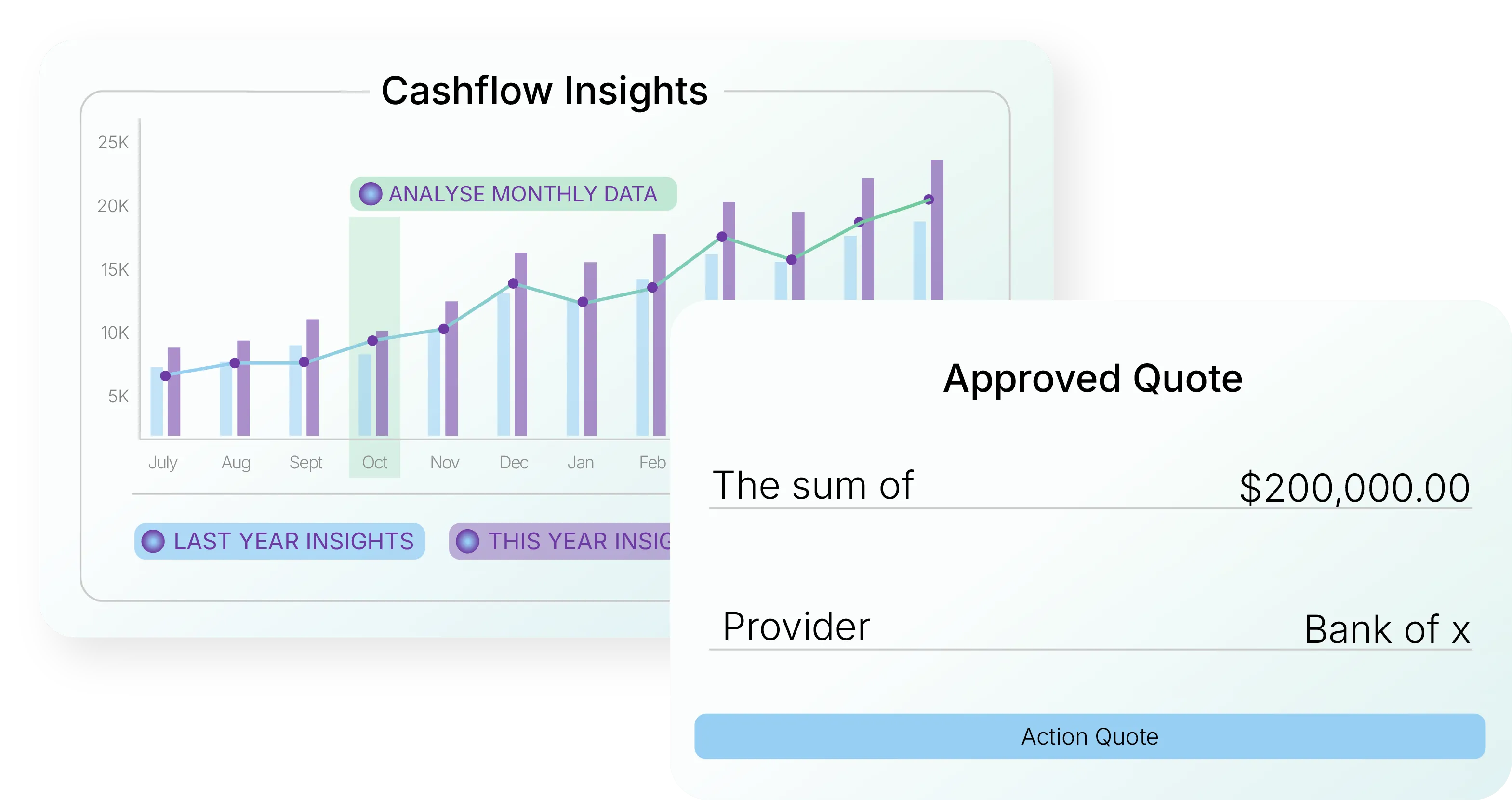

Embedded lending,

connecting every customer journey.

AI powered embedded lending gives B2B buyers the credit options they need, exactly when and where they need it. Our modular solution seamlessly connects merchants, lenders, and customers — accelerating deals, and growing finance penetration.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)